Price for Rubber; Natural (Excluding Latex), in Smoked Sheets in China - 2023

Contents:

- Price for Rubber; Natural (Excluding Latex), in Smoked Sheets in China (CIF) - 2023

- Price for Rubber; Natural (Excluding Latex), in Smoked Sheets in China (FOB) - 2022

- Imports of Rubber; Natural (Excluding Latex), in Smoked Sheets in China

- Exports of Rubber; Natural (Excluding Latex), in Smoked Sheets in China

Price for Rubber; Natural (Excluding Latex), in Smoked Sheets in China (CIF) - 2023

The average import price for rubber; natural (excluding latex), in smoked sheetses stood at $1,568 per ton in December 2023, therefore, remained relatively stable against the previous month. Over the period under review, the import price showed a relatively flat trend pattern. The most prominent rate of growth was recorded in October 2023 when the average import price increased by 3.3% against the previous month. The import price peaked at $1,575 per ton in May 2023; afterwards, it flattened through to December 2023.

Average prices varied noticeably amongst the major supplying countries. In December 2023, the countries with the highest prices were Indonesia ($1,655 per ton) and Thailand ($1,647 per ton), while the price for Vietnam ($1,495 per ton) and Myanmar ($1,499 per ton) were amongst the lowest.

From December 2022 to December 2023, the most notable rate of growth in terms of prices was attained by Vietnam (+0.7%), while the prices for the other major suppliers experienced more modest paces of growth.

Price for Rubber; Natural (Excluding Latex), in Smoked Sheets in China (FOB) - 2022

The average export price for rubber; natural (excluding latex), in smoked sheetses stood at $2,043 per ton in 2022, therefore, remained relatively stable against the previous year. Overall, the export price, however, saw a abrupt setback. The growth pace was the most rapid in 2017 an increase of 35%. The export price peaked at $3,519 per ton in 2012; however, from 2013 to 2022, the export prices failed to regain momentum.

Average prices varied noticeably for the major foreign markets. In 2022, amid the top suppliers, the highest price was recorded for prices to Russia ($2,243 per ton) and Taiwan (Chinese) ($2,093 per ton), while the average price for exports to Malaysia ($1,938 per ton) and Democratic People's Republic of Korea ($2,030 per ton) were amongst the lowest.

From 2012 to 2022, the most notable rate of growth in terms of prices was recorded for supplies to Russia (+4.7%), while the prices for the other major destinations experienced a decline.

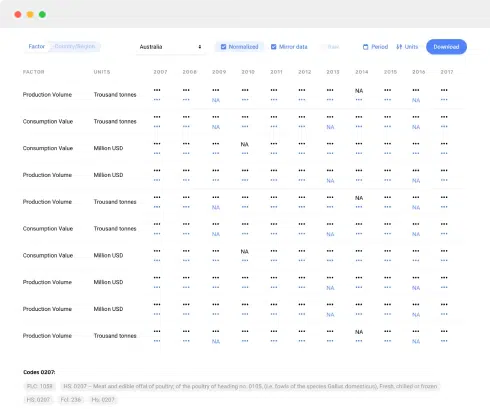

Imports of Rubber; Natural (Excluding Latex), in Smoked Sheets in China

In 2022, the amount of rubber; natural (excluding latex), in smoked sheetses imported into China was estimated at 218K tons, with an increase of 12% on the previous year's figure. The total import volume increased at an average annual rate of +10.4% from 2019 to 2022; however, the trend pattern indicated some noticeable fluctuations being recorded in certain years. The growth pace was the most rapid in 2021 with an increase of 18% against the previous year. Imports peaked in 2022 and are likely to see steady growth in years to come.

In value terms, imports of rubber; natural (excluding latex), in smoked sheetses stood at $387M in 2022. In general, total imports indicated a buoyant expansion from 2019 to 2022: its value increased at an average annual rate of +13.4% over the last three years. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2022 figures, imports increased by +49.7% against 2020 indices. The most prominent rate of growth was recorded in 2021 when imports increased by 47% against the previous year. Over the period under review, imports of reached the peak figure in 2022 and are likely to continue growth in the near future.

| Import of Rubber; Natural (Excluding Latex), in Smoked Sheets in China (Million USD) | |||||

|---|---|---|---|---|---|

| COUNTRY | 2019 | 2020 | 2021 | 2022 | CAGR, 2019-2022 |

| Thailand | 111 | 116 | 263 | 201 | 21.9% |

| Myanmar | 79.9 | 80.8 | 64.0 | 144 | 21.7% |

| Vietnam | 31.8 | 29.3 | 30.6 | 29.0 | -3.0% |

| Indonesia | 13.2 | 30.4 | 14.2 | 9.0 | -12.0% |

| Lao People's Democratic Republic | 28.4 | N/A | N/A | N/A | 0% |

| Others | 1.1 | 2.2 | 9.0 | 4.1 | 55.0% |

| Total | 266 | 259 | 381 | 387 | 13.3% |

Top Suppliers of Rubber; Natural (Excluding Latex), in Smoked Sheets to China in 2022:

- Thailand (106.4K tons)

- Myanmar (88.0K tons)

- Vietnam (16.9K tons)

- Indonesia (4.6K tons)

Exports of Rubber; Natural (Excluding Latex), in Smoked Sheets in China

In 2022, exports of rubber; natural (excluding latex), in smoked sheetses from China shrank markedly to 3.9K tons, with a decrease of -35.3% against the previous year. Over the period under review, exports recorded a slight curtailment. The most prominent rate of growth was recorded in 2021 with an increase of 151% against the previous year. As a result, the exports attained the peak of 6K tons, and then declined dramatically in the following year.

In value terms, exports of rubber; natural (excluding latex), in smoked sheetses dropped notably to $7.9M in 2022. In general, exports, however, saw a prominent increase. The pace of growth was the most pronounced in 2021 with an increase of 207% against the previous year. As a result, the exports reached the peak of $12M, and then fell remarkably in the following year.

| Export of Rubber; Natural (Excluding Latex), in Smoked Sheets in China (Million USD) | |||||

|---|---|---|---|---|---|

| COUNTRY | 2019 | 2020 | 2021 | 2022 | CAGR, 2019-2022 |

| Democratic People's Republic of Korea | 6.1 | 3.6 | 9.2 | 7.1 | 5.2% |

| Taiwan (Chinese) | 0.3 | N/A | 0.1 | 0.4 | 10.1% |

| Russia | N/A | N/A | N/A | 0.4 | 0% |

| Myanmar | N/A | N/A | 2.8 | N/A | 0% |

| Others | N/A | 0.3 | 0.1 | N/A | -66.7% |

| Total | 6.5 | 4.0 | 12.2 | 7.9 | 6.7% |

Top Export Markets for Rubber; Natural (Excluding Latex), in Smoked Sheets from China in 2022:

- Democratic People's Republic of Korea (3476.5 tons)

- Taiwan (Chinese) (200.0 tons)

- Russia (172.1 tons)

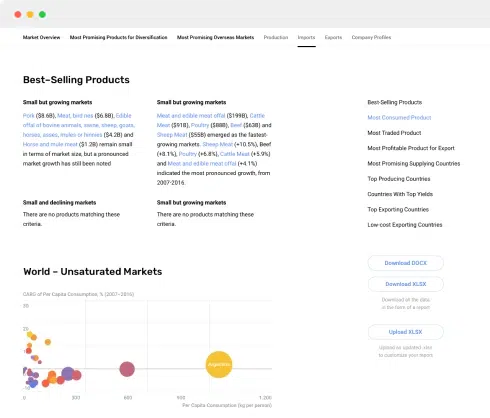

This report provides an in-depth analysis of the market for natural rubber and gum in China.

This report provides an in-depth analysis of the global market for natural rubber and gum.

This report provides an in-depth analysis of the market for natural rubber and gum in China.

This report provides an in-depth analysis of the global market for natural rubber and gum.

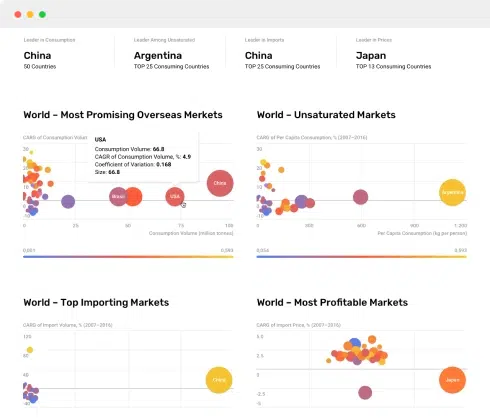

In the beginning of 2021, demand for natural rubber spiked and prices for rubber increased due to a quick rebound in China’s tire manufacturing and the heightened need for latex gloves during the pandemic. Rubber production is projected to climb up this year in line with rising demand, slowing down the price growth. There is a risk that droughts in Malaysia, Thailand and Indonesia will create a supply shortage in the market and enable the prices to soar again.

The global natural rubber and gum market amounted to $25.2B in 2019, therefore, remained relatively stable against...

In value terms, natural rubber, balata, gutta-percha, guayule imports stood at $X in 2016. In general, natural rubber, balata, gutta-percha, guayule imports continue to indicate a measured decline. ...

In value terms, natural rubber, balata, gutta-percha, guayule exports stood at $X in 2016. Overall, natural rubber, balata, gutta-percha, guayule exports continue to indicate a significant deduction...

Global natural rubber and gum consumption amounted to X thousand tons in 2015, moving up by +X% against the previous year level.

In 2015, the countries with the highest levels of production were Thailand (X thousand tons), Indonesia (X thousand tons), Vietnam (X thousand tons), together accounting for X% of total output.

Despite a drop in exports in 2014, Thailand continues to lead the way in the global natural rubber and gum trade. In 2014, Thailand exported X thousand tons of natural rubber and gums totaling X million USD, X% under the previous year. Its p

In the beginning of 2021, demand for natural rubber spiked and prices for rubber increased due to a quick rebound in China’s tire manufacturing and the heightened need for latex gloves during the pandemic. Rubber production is projected to climb up this year in line with rising demand, slowing down the price growth. There is a risk that droughts in Malaysia, Thailand and Indonesia will create a supply shortage in the market and enable the prices to soar again.

The global natural rubber and gum market amounted to $25.2B in 2019, therefore, remained relatively stable against...

In value terms, natural rubber, balata, gutta-percha, guayule imports stood at $X in 2016. In general, natural rubber, balata, gutta-percha, guayule imports continue to indicate a measured decline. ...