Stainless Steel in Ingots or other Primary Forms Market

The article discusses the increasing demand for stainless steel in ingots or other primary forms globally, with the market expected to show continued growth in consumption over the next eight years. Market performance is forecasted to expand with a CAGR of +0.0% in volume and +2.3% in value from 2022 to 2030, reaching 4.3M tons and $13.3B respectively by the end of 2030. The largest consumer and producer of stainless steel in ingots or other primary forms is China, followed by Sweden and Indonesia. Import and export trends are also analyzed, with Indonesia leading exports and China leading imports. The article provides insights into production, consumption, and pricing trends in the global stainless steel market.

Market Forecast

Driven by increasing demand for stainless steel in ingots or other primary forms worldwide, the market is expected to continue an upward consumption trend over the next eight years. Market performance is forecast to decelerate, expanding with an anticipated CAGR of +0.0% for the period from 2022 to 2030, which is projected to bring the market volume to 4.3M tons by the end of 2030.

In value terms, the market is forecast to increase with an anticipated CAGR of +2.3% for the period from 2022 to 2030, which is projected to bring the market value to $13.3B (in nominal prices) by the end of 2030.

Consumption

World Consumption of Stainless Steel in Ingots or other Primary Forms

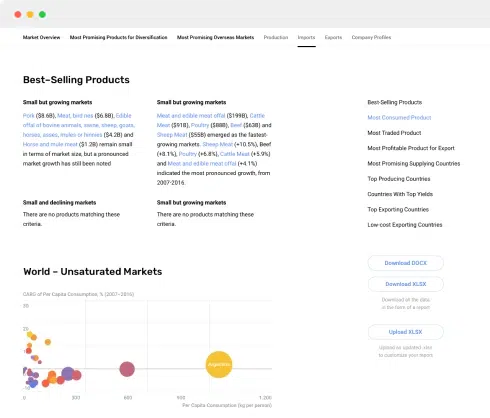

For the third consecutive year, the global market recorded growth in consumption of stainless steel in ingots or other primary forms, which increased by 18% to 4.3M tons in 2022. In general, the total consumption indicated a resilient increase from 2012 to 2022: its volume increased at an average annual rate of +5.5% over the last decade. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2022 figures, consumption increased by +83.4% against 2019 indices. Over the period under review, global consumption of reached the maximum volume in 2022 and is expected to retain growth in years to come.

The value of the market for stainless steel in ingots or other primary forms worldwide skyrocketed to $11.1B in 2022, growing by 27% against the previous year. This figure reflects the total revenues of producers and importers (excluding logistics costs, retail marketing costs, and retailers' margins, which will be included in the final consumer price). Over the period under review, consumption continues to indicate a buoyant increase. Global consumption peaked in 2022 and is likely to continue growth in the near future.

Consumption By Country

The country with the largest volume of consumption of stainless steel in ingots or other primary forms was China (1.6M tons), comprising approx. 36% of total volume. Moreover, consumption of stainless steel in ingots or other primary forms in China exceeded the figures recorded by the second-largest consumer, Sweden (409K tons), fourfold. Taiwan (Chinese) (373K tons) ranked third in terms of total consumption with an 8.6% share.

From 2012 to 2022, the average annual rate of growth in terms of volume in China totaled +39.6%. In the other countries, the average annual rates were as follows: Sweden (+5.7% per year) and Taiwan (Chinese) (+12.1% per year).

In value terms, China ($3.8B) led the market, alone. The second position in the ranking was held by Sweden ($1.4B). It was followed by Italy.

From 2012 to 2022, the average annual rate of growth in terms of value in China totaled +37.0%. In the other countries, the average annual rates were as follows: Sweden (+6.4% per year) and Italy (+13.3% per year).

In 2022, the highest levels of per capita consumption of stainless steel in ingots or other primary forms was registered in Iceland (479 kg per person), followed by Sweden (39 kg per person), Hungary (19 kg per person) and Greece (17 kg per person), while the world average per capita consumption of stainless steel in ingots or other primary forms was estimated at 0.5 kg per person.

From 2012 to 2022, the average annual rate of growth in terms of the per capita consumption of stainless steel in ingots or other primary forms in Iceland totaled -8.8%. In the other countries, the average annual rates were as follows: Sweden (+4.7% per year) and Hungary (-7.4% per year).

Production

World Production of Stainless Steel in Ingots or other Primary Forms

In 2022, production of stainless steel in ingots or other primary forms increased by 8.7% to 4.1M tons, rising for the third year in a row after two years of decline. Over the period under review, the total production indicated a perceptible expansion from 2012 to 2022: its volume increased at an average annual rate of +4.7% over the last decade. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2022 figures, production increased by +88.0% against 2019 indices. The growth pace was the most rapid in 2021 when the production volume increased by 34%. Global production peaked in 2022 and is expected to retain growth in the near future.

In value terms, production of stainless steel in ingots or other primary forms skyrocketed to $6.4B in 2022 estimated in export price. The total output value increased at an average annual rate of +2.3% from 2012 to 2022; however, the trend pattern indicated some noticeable fluctuations being recorded throughout the analyzed period. As a result, production reached the peak level and is likely to continue growth in the immediate term.

Production By Country

The country with the largest volume of production of stainless steel in ingots or other primary forms was Indonesia (1.8M tons), accounting for 45% of total volume. Moreover, production of stainless steel in ingots or other primary forms in Indonesia exceeded the figures recorded by the second-largest producer, the UK (384K tons), fivefold. The third position in this ranking was taken by Sweden (314K tons), with a 7.7% share.

From 2012 to 2022, the average annual rate of growth in terms of volume in Indonesia stood at +108.9%. The remaining producing countries recorded the following average annual rates of production growth: the UK (+0.4% per year) and Sweden (+4.4% per year).

Imports

World Imports of Stainless Steel in Ingots or other Primary Forms

In 2022, global imports of stainless steel in ingots or other primary forms soared to 2.7M tons, picking up by 17% compared with the year before. In general, imports enjoyed a buoyant expansion. The growth pace was the most rapid in 2017 with an increase of 110%. Global imports peaked in 2022 and are likely to see gradual growth in the immediate term.

In value terms, imports of stainless steel in ingots or other primary forms skyrocketed to $7.3B in 2022. Over the period under review, imports saw a remarkable increase. The most prominent rate of growth was recorded in 2021 with an increase of 97%. Over the period under review, global imports of hit record highs in 2022 and are expected to retain growth in the near future.

Imports By Country

China dominates forms structure, reaching 1.6M tons, which was near 58% of total imports in 2022. India (247K tons) held a 9.1% share (based on physical terms) of total imports, which put it in second place, followed by Taiwan (Chinese) (9.1%) and Sweden (5.5%). The following importers - France (98K tons), Italy (75K tons) and the United States (68K tons) - together made up 8.9% of total imports.

Imports into China increased at an average annual rate of +39.6% from 2012 to 2022. At the same time, India (+49.6%), Taiwan (Chinese) (+34.3%), France (+11.9%), Italy (+7.2%) and Sweden (+4.7%) displayed positive paces of growth. Moreover, India emerged as the fastest-growing importer imported in the world, with a CAGR of +49.6% from 2012-2022. By contrast, the United States (-8.3%) illustrated a downward trend over the same period. While the share of China (+50 p.p.), India (+8.5 p.p.) and Taiwan (Chinese) (+7.2 p.p.) increased significantly in terms of the global imports from 2012-2022, the share of Italy (-2.8 p.p.), Sweden (-8.6 p.p.) and the United States (-21.5 p.p.) displayed negative dynamics. The shares of the other countries remained relatively stable throughout the analyzed period.

In value terms, China ($3.6B) constitutes the largest market for imported stainless steel in ingots or other primary forms worldwide, comprising 48% of global imports. The second position in the ranking was taken by India ($669M), with a 9.1% share of global imports. It was followed by Sweden, with a 7.6% share.

In China, imports of stainless steel in ingots or other primary forms expanded at an average annual rate of +35.1% over the period from 2012-2022. In the other countries, the average annual rates were as follows: India (+47.4% per year) and Sweden (+5.7% per year).

Import Prices By Country

In 2022, the average import price for stainless steel in ingots or other primary forms amounted to $2,717 per ton, picking up by 14% against the previous year. Overall, the import price, however, showed a perceptible descent. The most prominent rate of growth was recorded in 2021 an increase of 30% against the previous year. Over the period under review, average import prices hit record highs at $3,505 per ton in 2012; however, from 2013 to 2022, import prices stood at a somewhat lower figure.

Prices varied noticeably by country of destination: amid the top importers, the country with the highest price was the United States ($4,550 per ton), while Taiwan (Chinese) ($2,199 per ton) was amongst the lowest.

From 2012 to 2022, the most notable rate of growth in terms of prices was attained by the United States (+3.5%), while the other global leaders experienced mixed trends in the import price figures.

Exports

World Exports of Stainless Steel in Ingots or other Primary Forms

For the third year in a row, the global market recorded growth in overseas shipments of stainless steel in ingots or other primary forms, which increased by 2.3% to 2.4M tons in 2022. In general, exports saw a prominent expansion. The pace of growth appeared the most rapid in 2017 when exports increased by 104% against the previous year. Over the period under review, the global exports of reached the maximum in 2022 and are expected to retain growth in the near future.

In value terms, exports of stainless steel in ingots or other primary forms surged to $6.6B in 2022. Overall, exports continue to indicate a prominent expansion. The growth pace was the most rapid in 2021 when exports increased by 100% against the previous year. The global exports peaked in 2022 and are expected to retain growth in the near future.

Exports By Country

Indonesia prevails in forms structure, amounting to 1.8M tons, which was approx. 75% of total exports in 2022. It was distantly followed by the UK (210K tons), constituting an 8.6% share of total exports. South Korea (71K tons), Germany (57K tons), Sweden (54K tons) and Italy (37K tons) took a little share of total exports.

Indonesia was also the fastest-growing in terms of the stainless steel in ingots or other primary forms exports, with a CAGR of +105.0% from 2012 to 2022. At the same time, South Korea (+37.7%) and Germany (+3.1%) displayed positive paces of growth. The UK experienced a relatively flat trend pattern. By contrast, Sweden (-1.4%) and Italy (-9.4%) illustrated a downward trend over the same period. From 2012 to 2022, the share of Indonesia and South Korea increased by +74 and +2.5 percentage points, respectively.

In value terms, Indonesia ($4.1B) remains the largest stainless steel in ingots or other primary forms supplier worldwide, comprising 62% of global exports. The second position in the ranking was taken by the UK ($808M), with a 12% share of global exports. It was followed by Sweden, with a 4.4% share.

In Indonesia, exports of stainless steel in ingots or other primary forms increased at an average annual rate of +115.3% over the period from 2012-2022. The remaining exporting countries recorded the following average annual rates of exports growth: the UK (+1.6% per year) and Sweden (+0.1% per year).

Export Prices By Country

The average export price for stainless steel in ingots or other primary forms stood at $2,690 per ton in 2022, growing by 15% against the previous year. In general, the export price, however, showed a mild contraction. The growth pace was the most rapid in 2021 when the average export price increased by 23% against the previous year. The global export price peaked at $3,328 per ton in 2014; however, from 2015 to 2022, the export prices stood at a somewhat lower figure.

Prices varied noticeably by country of origin: amid the top suppliers, the country with the highest price was Italy ($5,586 per ton), while South Korea ($1,923 per ton) was amongst the lowest.

From 2012 to 2022, the most notable rate of growth in terms of prices was attained by Italy (+5.7%), while the other global leaders experienced more modest paces of growth.

Explore the top import markets for raw steel and steel semi-finished products worldwide. Get key statistics and insights from the IndexBox market intelligence platform.

The beginning of 2021 saw a sharp increase in the steel demand, while metallurgical plants were still recovering from the operational downtime incurred during the lockdown. This market disbalance leads to an increase in steel prices. The recovery of the automotive sector and other downstream industries in 2020, at a faster pace than expected, generates the conditions for robust steel demand in the medium term.

In value terms, ferro-cerium and other pyrophoric alloys imports amounted to $X in 2016. The total import value increased at an average annual rate of +X% from 2007 to 2016; the trend pattern ind...

In value terms, ferro-cerium and other pyrophoric alloys exports totaled $X in 2016. In general, ferro-cerium and other pyrophoric alloys exports continue to indicate a relatively flat trend patter...

In 2016, approx. X tons of steel were imported worldwide- moving up by X% against the previous year level. In general, steel imports continue to indicate a relatively flat trend pattern. The pace...

In 2016, approx. X tons of steel were imported worldwide- moving up by X% against the previous year level. In general, steel imports continue to indicate a relatively flat trend pattern. The pace...